Variable interest entity model. ASU 2014-07 Consolidation Topic 810.

Bob Jensen S Overview Of Special Purpose Entities Spes

FIN 46R Consolidation of Variable Interest EntitiesAn Interpretation of ARB No.

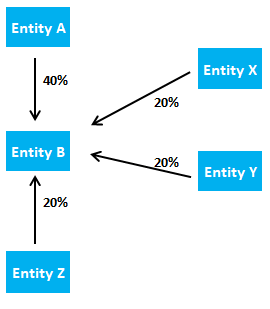

Variable interest entity accounting treatment. Here we discuss the conceptual examples of the variable interest entity. The accounting treatment is very different based on the result of that determination. 21 Scope of consolidation guidance.

First entities are subjected to the variable interest entity VIE model. A variable interest rate loan with a stated maturity date that permits the borrower to change the period of the market interest rate at each interest reset date on an ongoing basis. Consolidation for investment managers.

Residual equity holders do not control the VIE. Applying Variable Interest Entities Guidance to Common Control Leasing Arrangements allows the reporting. Interest and accounting for changes in ownership interests May 2020 To our clients and other friends.

The interest rate has an interest rates. In this arrangement an Equity investment of 03 million is 100 outside of Enron and thus would make SPE independent of. 51 was issued in December 2003 in response to accounting scandals in which certain types of variable interest entities VIE were used to structure transactions that excluded assets and liabilities from audited consolidated financial statements.

AUDIT 2 FEBRUARY 2020 US. An LLC which is often a VIE ASC 810-10. 2111 Virtual SPEs or portions of legal entities.

GAAP IFRS Relevant guidance ASC 810 IFRS 10 and 12 Consolidation models There are two consolidation models. If the VIE model is not applicable. 212 Scope exceptions to the VIE model.

Determine whether the Fund is a variable interest entity. Another challenge is identifying all of the. The consolidation of a variable interest entity that is a collateralized financing entity SPECIAL REPORT.

Not all special purpose entities SPEs are VIEs but generally all securitization SPEs are VIEs. Consolidation of Variable Interest Entitiesan interpretation of ARB No. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features.

A VIE does not usually issue equity instruments with voting rights. Variable Interest Entity means any corporation partnership limited partnership limited liability company limited liability partnership or other entity the accounts of which would be required to be consolidated with those of the Company in the Companys consolidated financial statements if such financial statements were prepared in accordance with GAAP solely because of the application of. A variable interest entity VIE is a legal entity in which an investor holds a controlling interest despite not having a majority of its share ownership.

Variable Interest Entities and Requirement for Consolidation The term variable interest entityas used by the United States Financial Accounting Standards Board the FASB in its Accounting Standards Codification ASC 810-10 generally refers to an. An accounting alternative that was issued by the Financial Accounting Standards Board FASB on March 20 would if certain conditions are met exempt private companies from applying variable interest entity VIE guidance to lessors under common-control leasing arrangements. 211 Consolidation background and general considerations.

After establishing the VOEVIE consolidation model in ASC 810 FASB and the Private Company Council a FASB advisory group focusing on application of FASB guidance to nonpublic companies issued several amendments. Guide to what is Variable Interest Entity VIE and its definition. A loan that pays an inverse floating rate ie.

FASB Issues GAAP Variable Interest Entity Alternative. Included in ASC 810 Consolidationin particular the variable interest entity VIE subsections. 2112 Consolidation of majority-owned or wholly-owned subsidiaries.

IFRS 11 Joint Arrangements IFRS 12 Disclosure of Interests in Other Entities IAS 27 Separate Financial. FASB Accounting Standards Codification Topic 810 Consolidation establishes criteria for analyzing entities for consolidation when preparing financial statements in conformity with GAAP. 51 Summary This Interpretation of Accounting Research Bulletin No.

ASC 812 which will separately address variable interest entities and voting interest entities in response to stakeholders concerns that todays guidance is. Many private companies frequently engage in common control arrangements that may be subject to complex variable-interest entity VIE guidance. A Variable Interest Entity VIE is an entity in which an investor has a variable interest that is not based on the majority of voting rights Renewable energy facilities are typically owned by a separate legal entity eg.

The entitys equity is not sufficient to support its operations. An entity may apply IFRS 10 to an earlier accounting period but if doing so it must disclose the fact that is has early adopted the standard and also apply. Last year FASB issued a financial accounting and reporting standard that provides private companies an accounting policy election not to apply VIE guidance to legal entities under common control including common control leasing arrangements.

A VIE has the following characteristics. 51 Consolidated Financial Statements addresses consolidation by business enterprises of variable interest entities which have one or both of the following characteristics. 2014-07 March 2014 Consolidation Topic 810 Applying Variable Interest Entities Guidance to Common Control Leasing Arrangements a consensus of the Private Company Council Accounting.

An Amendment of the FASB Accounting Standards Codification No.

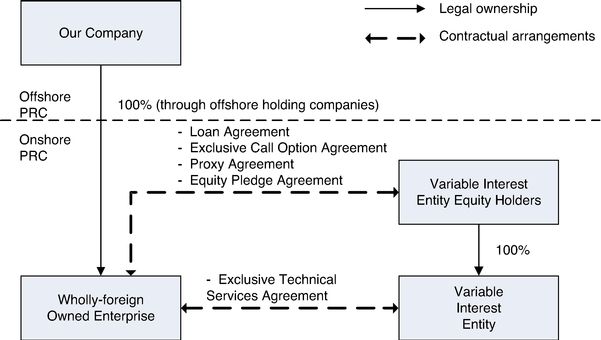

20 F 1 A2235254z20 F Htm 20 F Use These Links To Rapidly Review The Document Table Of Contents Index To Financial Statements Table Of Contents United States Securities And Exchange Commission Washington D C 20549 Form

China S Variable Interest Entity Structure Explained Suede Investing

Variable Interest Entity Vie Overview Advantages And Disadvantages

20 F 1 A2235254z20 F Htm 20 F Use These Links To Rapidly Review The Document Table Of Contents Index To Financial Statements Table Of Contents United States Securities And Exchange Commission Washington D C 20549 Form