A variable interest entity VIE refers to a legal business structure in which an investor has a controlling interest despite not having a majority of voting rights.

Chinese Vie Companies What Lawyers And Analysts Say About Existential Risk To Global Stock Investors

Variable Interest Entities in China A.

Variable interest entity (vie) china. The shares of many Chinese. We find that the use of VIEs for such ends is widespread growing and associated with valuation discounts of as much as 30 percent relative to Chinese non-VIE firms listed in the US. Companies invested or considering investing in variable-interest entity VIE structures in China should take precautionary measures to protect against risks illustrated by recent events in China and the United States.

I have selected E-Commerce Dangdang Inc. A VIE is a company that is included in consolidated financial statements because it is controlled. To achieve the initial public offering IPO there are two options for Chinese companies onshore listing also known as A-share listing and offshore listing also known as.

But a crackdown by Beijing on Chinas 100bn tutoring industry over the past week has included a ban on companies using this structure known as the variable interest entity VIE raising the. Thats because Chinese companies use a structure called a variable interest entity or VIE in order to raise money from foreign investors. The structure is at odds with Chinese foreign investment.

The variable interest entity VIE corporate structure. China is an economy that imposes foreign ownership restrictions and currency controls on its businesses. History of Foreign Investments Restrictions Since 1949 the PRC has operated under the unitary rule of the Chinese Com-munist Party CCPII Mao Zedong chairman of the CCP strived to achieve a.

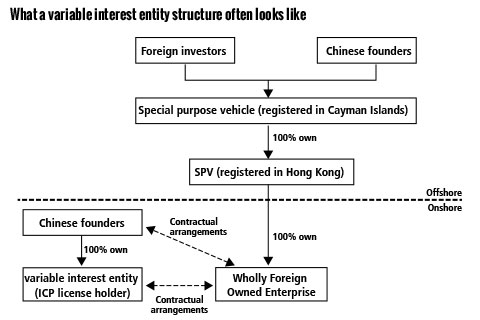

And so this is where the Variable Interest Entity VIE comes into play. The structure uses two entities. Variable Interest Entity Structure in China.

DANG which listed on the NYSE late in 2010 as an example of how the. Today Bloomberg reports that sources say the China Securities Regulatory Commission is leading efforts to revise rules on overseas listings that have been in effect since 1994 that would require firms structured using the so-called Variable Interest Entity VIE model to seek approval before going public in Hong Kong or the US. Dismantling VIE could be next carnage scene as China decouples.

A VIE is an. Variable Interest Entities or VIEs is one option international tech companies have to enter China without relying on a Chinese partner. To non-accountants the VIE structure is a business structure that is widely used in certain business sectors in China that have.

Explaining VIE structures in China This posting will explain the use of variable interest entities VIEs by US. To avoid these limitations Chinese companies developed the variable interest entity structure through which offshore entities can own up to 100 of an. Events are rapidly colliding due to conflicting national policies between the US and China.

While there is dissent in China regarding whether or not US. Variable interest entities are used by businesses in sectors where China limits foreign ownership including telecommunications and education to let foreign investors buy in through shell. We investigate Chinese firms use of variable interest entities VIEs to evade Chinese regulation on foreign ownership and list in the US.

Exchanges relying heavily on a corporate structure called a variable interest entity VIE. Variable Interest Entities in China 13 March 2019 Investors in Chinese companies soon encounter an obscure accounting term the variable interest entity or VIE. Chinese Companies and the VIE Structure Foreword Over the last 18 years an increasing number of Chinese companies have listed on US.

Variable Interest Entities are a legal quagmire for investors to grapple with if they want exposure to the fast-growing internet enabled businesses in China. Dollars or the Chinese renminbi are better for these sensitive industries as of now the dollar prevails as the currency of choice. Most investors prefer not to deal with regulatory risk.

Chinese companies listed on US stock exchanges must disclose the risks of Chinas government interfering with their business the SEC has said. By Peter Guy Posted 29 July 2021. Wall Street this week received a shock lesson in capitalism with Chinese characteristics as Beijings preferred market setup is often described.

By Zeng Xianwu Bai Lihui King Woods Foreign Direct Investment FDI Group. Mark provides an ov. The accounting definition of variable interest entity VIE is an entity in which an investor holds a controlling interest based on contractual arrangements and not based on owning the majority of voting rights.

Or it may refer to an. A VIE is a financial designation that requires. Its very hard to model out such a risk in seemingly binary outcomes.

Variable interest entities VIEs allow Chinese companies to list on foreign exchangesbut Chinas rules could be changing.

The Vie Structure Past Present And Future Part I Hong Kong Lawyer

Vie Like Structure Affirmed By Supreme People S Court In China

The Big Vie Question Caixin Global