The structure is at odds with Chinese foreign investment. China is an economy that imposes foreign ownership restrictions and currency controls on its businesses.

Explaining Vie Structures China Accounting Blog Paul Gillis

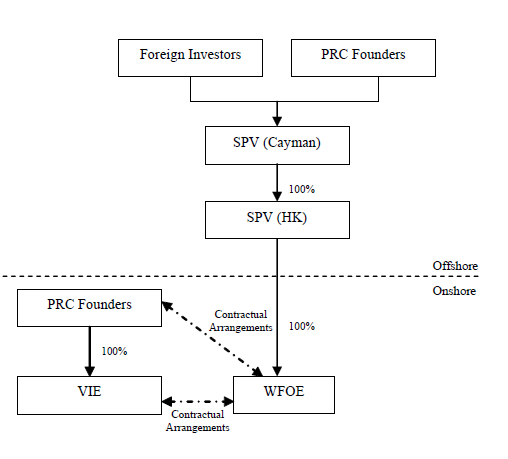

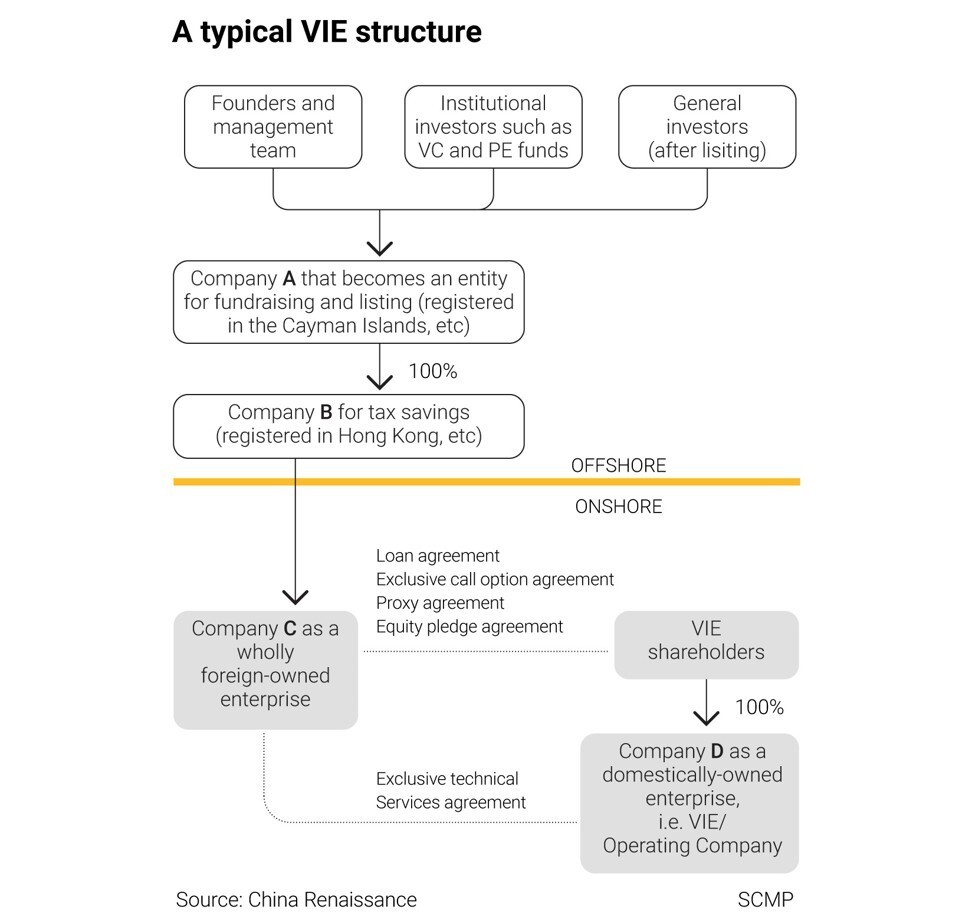

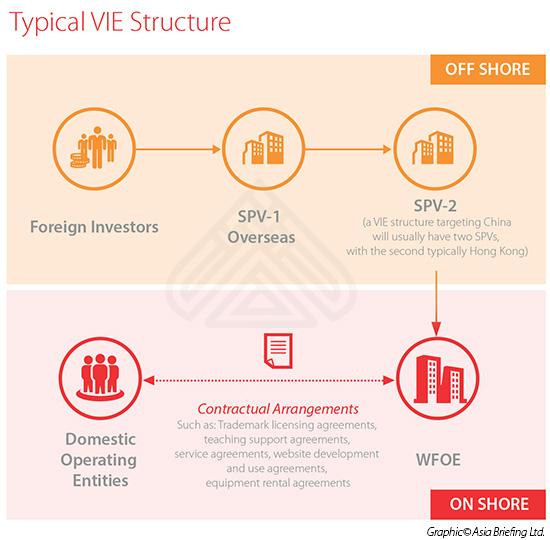

Variable interest entity structure china. A note on the variable interest entity VIE structure that is commonly used for Chinese companies. The accounting definition of variable interest entity VIE is an entity in which an investor holds a controlling interest based on contractual arrangements and not based on owning the majority of voting rights. By Zeng Xianwu Bai Lihui King Woods Foreign Direct Investment FDI Group.

Variable Interest Entity Structure in China. The note explains the history and origins of the structure the elements of the structure the key contracts that make up the structure and the key clauses required in. We investigate Chinese firms use of variable interest entities VIEs to evade Chinese regulation on foreign ownership and list in the US.

Variable Interest Entities are a legal quagmire for investors to grapple with if they want exposure to the fast-growing internet enabled businesses in China. The use of the VIE structure is not only. But a crackdown by Beijing on Chinas 100bn tutoring industry over the past week has included a ban on companies using this structure known as the variable interest entity VIE raising the.

To avoid these limitations Chinese companies developed the variable interest entity structure through which offshore entities can own up to 100 of an. Variable interest entities are used by businesses in sectors where China limits foreign ownership including telecommunications and education to let foreign investors buy in through shell. A note on the variable interest entity VIE structure that is commonly used for Chinese companies.

To non-accountants the VIE structure is a business structure that is widely used in certain business sectors in China that have. Variable interest entities VIEs allow Chinese companies to list on foreign exchangesbut Chinas rules could be changing. The variable interest entity VIE has long been a popular structure for foreign parties to invest in sectors which are restricted by Chinas industrial policy to foreign investment.

Are facing increasing. Exchanges relying heavily on a corporate structure called a variable interest entity VIE. GUEST SERIES Variable Interest Entities in China 13 March 2019 Investors in Chinese companies soon encounter an obscure accounting term the variable interest entity or VIE.

We find that the use of VIEs for such ends is widespread growing and associated with valuation discounts of as much as 30 percent relative to Chinese non-VIE firms listed in the US. Chinese Companies and the VIE Structure Foreword Over the last 18 years an increasing number of Chinese companies have listed on US. To achieve the initial public offering IPO there are two options for Chinese companies onshore listing also known as A-share listing and offshore listing also known as.

The note explains the history and origins of the structure the elements of the structure the key contracts that make up the structure and the key clauses required in. Looking down on office buildings and. Variable Interest Entities VIE is an investment structure used by many Chinese companies and foreign investors to bypass Chinese government restrictions on FDI24 The VIE structure 14 WAYNE M.

A revocation of the rights of Variable Interest Entities VIEs would instantly destroy these companies and with them Chinas internet and tech sectors. Most investors prefer not to deal with regulatory risk. The variable interest entity VIE corporate structure.

We conduct what is to our knowledge the first systematic examination of Chinese-based firms that utilize a variable interest entity VIE structure to evade Chinese regulation on foreign ownership to list equity in the US. China would ramp up efforts to seal the loopholes around the Variable Interest Entity model an equity structure that Chinese companies have exploited in past years to attract foreign investment. A VIE is an.

Its very hard to model out such a risk in seemingly binary outcomes. In addition the VIE structure has also been used as a means by which Chinese domestic entities could list offshore on international capital markets. And Chinese Regulators Are in a Bind Over a Three-Letter Acronym Variable interest entities or VIEs that enabled many Chinese companies to raise money in the US.

A VIE is a company that is included in consolidated financial statements because it.

Legally Ambiguous Vie Structure Means Foreign Investors Don T Technically Own Overseas Listed Chinese Stocks And That Could Spell Disaster South China Morning Post

Investing In China S Education Industry Part 1 China Briefing News

Foreign Investment Law Series 05 The Vie Structure Remains In Grey Area China Justice Observer

New Mainland China Implementation Rules For The Law For Promoting Private Education Implications For Investments Into Vie Structures