This definition appears very frequently and is found in the following Acronym Finder categories. Variable Interest Entity Structure in China.

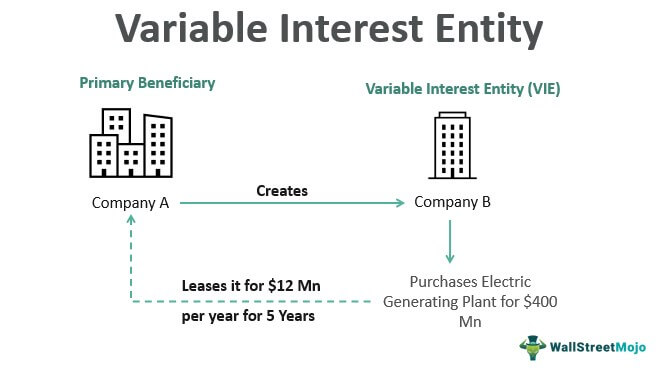

Variable Interest Entity Vie Definition Examples With Explanation

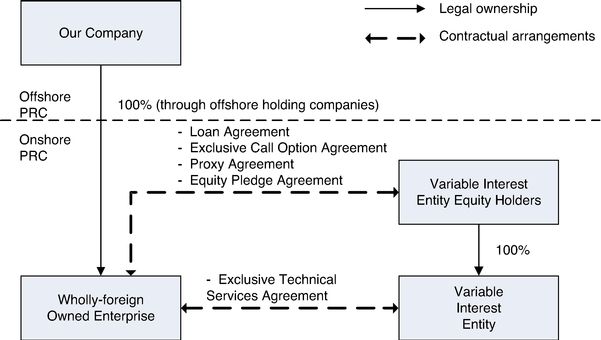

In addition the VIE structure has also been used as a means by which Chinese domestic entities could list offshore on international capital markets.

Vie variable interest entity definition. Financial Accounting Standards Board FASB is an entity that an investor has a controlling interest in but this controlling interest is not based on a majority of voting rights. Here we discuss the conceptual examples of the variable interest entity. By Zeng Xianwu Bai Lihui King Woods Foreign Direct Investment FDI Group.

FIN 46R Consolidation of Variable Interest EntitiesAn Interpretation of ARB No. See other definitions of VIE. Conditions that identify an entity as a VIE Except -ASC 810-10-15-14b on the ability of equity holders as a group to make decisions Definition of a variable interest Modification of whether fees paid to a decision maker or service provider are variable.

DANG which listed on the NYSE late in 2010 as an example of how the. 51 was issued in December 2003 in response to accounting scandals in which certain types of variable interest entities VIE were used to structure transactions that excluded assets and liabilities from audited consolidated financial statements. Tell a friend about us add a link to this page or visit the webmaster.

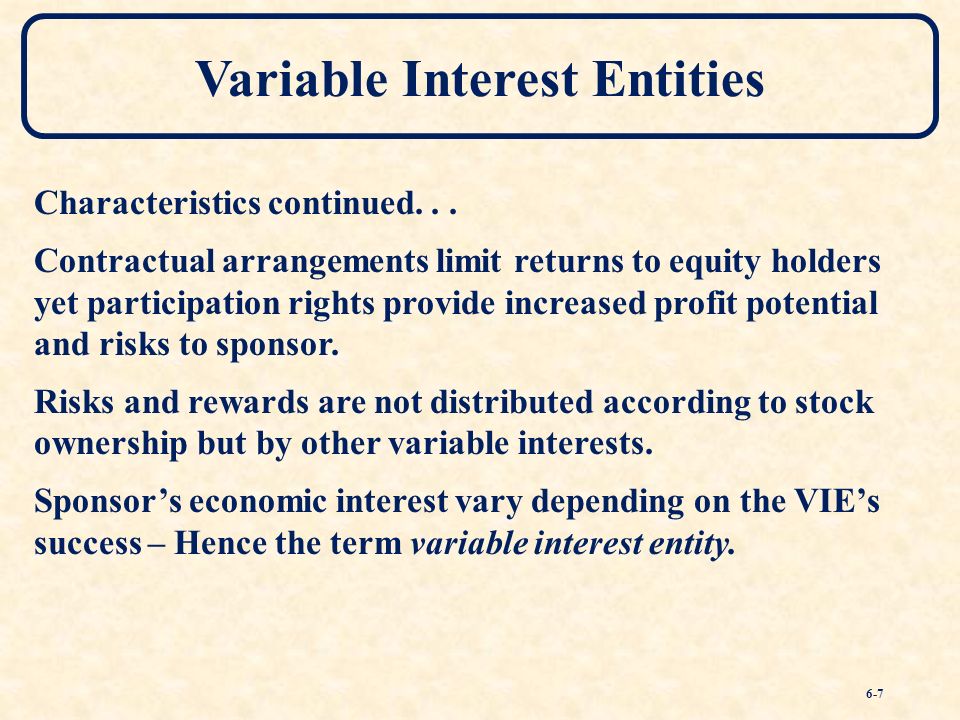

A variable interest entity VIE is a legal entity in which an investor holds a controlling interest despite not having a majority of its share ownership. Last year FASB issued a financial accounting and reporting standard that provides private companies an accounting policy election not to apply VIE guidance to legal entities under common control including common control leasing arrangements.

After establishing the VOEVIE consolidation model in ASC 810 FASB and the Private Company Council a FASB advisory group focusing on application of FASB guidance to nonpublic companies issued several amendments. Variable Interest Entity listed as VIE. Looking for abbreviations of VIE.

A variable interest entity VIE as reported by the US. VIE - Variable Interest Entity. The entitys equity is not sufficient to support its operations.

Somewhat similar to the special purpose entity the variable interest entity has been define. The VIE model provides a scope exception from the application of that model to a joint venture if the joint venture is a business and certain conditions are met which is discussed in EM 621. Determining whether the VIE model applies to an entity that meets the definition of a business can be one of the more challenging aspects of ASC 810.

The variable interest entity VIE has long been a popular structure for foreign parties to invest in sectors which are restricted by Chinas industrial policy to foreign investment. To non-accountants the VIE structure is a business structure that is widely used in certain business sectors in China that have. The accounting definition of variable interest entity VIE is an entity in which an investor holds a controlling interest based on contractual arrangements and not based on owning the majority of voting rights.

Most investors prefer not to deal with regulatory risk. The variable interest entity VIE is a legal business structure that allows an investor to hold a controlling interest in the entity without that interest translating into possessing enough voting privileges to result in a majority. Consolidation of Variable Interest Entitiesan interpretation of ARB No.

In this arrangement an Equity investment of 03 million is 100 outside of Enron and thus would make SPE independent of. 51 Consolidated Financial Statements addresses consolidation by business enterprises of variable interest entities which have one or both of the following characteristics. Guide to what is Variable Interest Entity VIE and its definition.

An entity is subject to FIN 46-R and is called a Variable Interest Entity VIE if it has i equity that is insufficient to permit the entity to finance its activities without additional subordinated financial support or ii equity investors that cannot make significant decisions about the entitys operations or that do not absorb the majority of expected losses or receive the. Residual equity holders do not control the VIE. 51 Summary This Interpretation of Accounting Research Bulletin No.

833 Determining Whether the Reporting Entity Holds a Variable Interest Decision-Maker and Service-Provider Fees 194 834 Determining Whether a Legal Entity Is a VIE Analyzing Kick-Out and Participating Rights for a Legal Entity. I have selected E-Commerce Dangdang Inc. Us Consolidation guide 2124.

The VIE model provides the following scope exception the business scope exception for reporting entities having a variable interest s in a business entity. VIEs are subject to consolidation under certain conditions. Applying Variable Interest Entities Guidance to Common Control Leasing Arrangements allows the reporting entity.

Its very hard to model out such a risk in seemingly binary outcomes. To achieve the initial public offering IPO there are two options for Chinese companies onshore listing also known as A-share listing and offshore listing also known as. VIE stands for Variable Interest Entity US Financial Accounting Standards Board Suggest new definition.

Explaining VIE structures in China This posting will explain the use of variable interest entities VIEs by US. Variable Interest Entities are a legal quagmire for investors to grapple with if they want exposure to the fast-growing internet enabled businesses in China. Many private companies frequently engage in common control arrangements that may be subject to complex variable-interest entity VIE guidance.

If the entity is a VIE and is required to be consolidated by one of the investors it would not meet the definition of a joint venture. Suggest new definition Want to thank TFD for its existence. ASU 2014-07 Consolidation Topic 810.

The structure is at odds with Chinese foreign investment. It is Variable Interest Entity. A VIE has the following characteristics.

Variable Interest Entity Vie Overview Advantages And Disadvantages

Ppt Variable Interest Entities Powerpoint Presentation Free Download Id 138329

Chapter Six Variable Interest Entities Intra Entity Debt Consolidated Cash Flows And Other Issues Copyright C 2015 Mcgraw Hill Education All Rights Ppt Download