The accounting definition of variable interest entity VIE is an entity in which an investor holds a controlling interest based on contractual arrangements and not based on owning the majority of voting rights. A VIE is a company that is included in consolidated financial statements because it.

Foreign Investment Law Series 05 The Vie Structure Remains In Grey Area China Justice Observer

But a crackdown by Beijing on Chinas 100bn tutoring industry over the past week has included a ban on companies using this structure known as the variable interest entity VIE raising the.

Us china variable interest entity. And Chinese Regulators Are in a Bind Over a Three-Letter Acronym Variable interest entities or VIEs that enabled many Chinese companies to raise money in the US. A revocation of the rights of Variable Interest Entities VIEs would instantly destroy these companies and with them Chinas internet and tech sectors. To achieve the initial public offering IPO there are two options for Chinese companies onshore listing also known as A-share listing and offshore listing also known as.

The law using variable interest entities VIEs. As long as they meet listing requirements Chinas securities regulator told brokerages late Wednesday according to a. Looking down on office buildings and.

We investigate Chinese firms use of variable interest entities VIEs to evade Chinese regulation on foreign ownership and list in the US. Variable Interest Entities are a legal quagmire for investors to grapple with if they want exposure to the fast-growing internet enabled businesses in China. The SEC has also provided disclosure.

Variable interest entities VIEs allow Chinese companies to list on foreign exchangesbut Chinas rules could be changing. Its very hard to model out such a risk in seemingly binary outcomes. And so this is where the Variable Interest Entity VIE comes into play.

While there is dissent in China regarding whether or not US. Variable Interest Entity Structure in China. Securities and Exchange Commission SEC on Monday issued its latest warning to people looking to invest in Chinese companies listed in the United States.

In the United States VIEs are often formed as special purpose. Exchanges relying heavily on a corporate structure called a variable interest entity VIE. How China Played American Investors Shares tumbled this week as investors wondered what they really own when they buy Chinese stocks.

This is no small matter as new rules define what business deals may look like in China in the future hampering the ultra-acquisitive strategies of the likes of Tencent and Alibaba. The structure is at odds with Chinese foreign investment. Variable interest entities are used by businesses in sectors where China limits foreign ownership including telecommunications and education to let foreign investors buy in through shell.

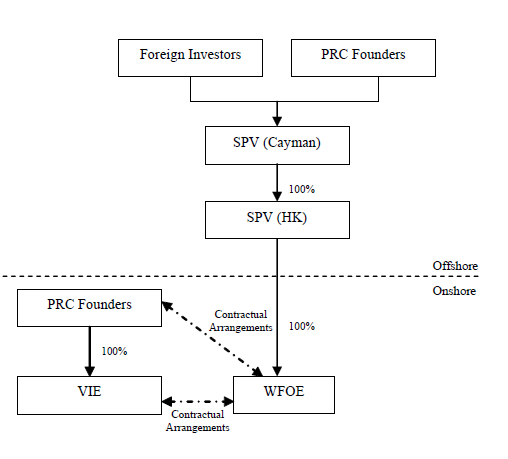

Investment is to use a variable interest entity. 1 In a typical Chinese VIE structure the foreign investors do not own shares directly in the Chinese operating entity but rather own shares in an intermediary wholly foreign-owned entity WFOE in China. A VIE is an.

Are facing increasing. China will continue to allow Chinese companies to go public in the US. Over the past 24 hours in a fund managers office somewhere some poor analyst has probably desperately typed variable interest entity China into Google in an attempt to figure out just.

If you hold shares in New York-listed Alibaba Group Holding Ltd you dont own a stake in a Chinese internet powerhouse. Circumvent these restrictions mainland Chinese companies interested in on US. To non-accountants the VIE structure is a business structure that is widely used in certain business sectors in China that have.

By Zeng Xianwu Bai Lihui King Woods Foreign Direct Investment FDI Group. An overlooked consequence of the crackdown on antitrust business moves in China is that variable interest entities or VIEs have finally been folded into the legal system. Exchanges create raising funds offshore corporate entities for foreign investment using a complex structure called a variable interest entity VIE.

11 In a March 2019 survey of 182. The China Securities Regulatory Commissions CSRC team will mainly sharpen its focus of companies seeking to list overseas using a structures known as Variable Interest Entities VIEs three. What you have are the American depositary receipts of a.

Chinese Companies and the VIE Structure Foreword Over the last 18 years an increasing number of Chinese companies have listed on US. GUEST SERIES Variable Interest Entities in China 13 March 2019 Investors in Chinese companies soon encounter an obscure accounting term the variable interest entity or VIE. US-listed Chinese internet companies such as search giant Baidu and e-commerce giant Alibaba Group Holding utilize a corporate structure called a variable interest entity.

Most investors prefer not to deal with regulatory risk. In an alert to investors the SEC detailed the potential risks in putting money into US-listed companies that have contracts with but no control over a Chinese entity known as a variable interest entity VIE. Some Chinese companies have now started to receive detailed instructions from the SEC about greater disclosure of their use of variable interest entities.

A trader works during the IPO for Chinese ride-hailing. We find that the use of VIEs for such ends is widespread growing and associated with valuation discounts of as much as 30 percent relative to Chinese non-VIE firms listed in the US. A way for Chinese internet companies to circumvent this rule and obtain US.

Dollars or the Chinese renminbi are better for these sensitive industries as of now the dollar prevails as the currency of choice.

The Vie Structure Past Present And Future Part I Hong Kong Lawyer

Vie Probably A Practical Option For Foreign Investors In Language Training Business Chinese Lawyer In Shanghai Shenzhen Guangzhou And Beijing

Analysis On Vie Structure Related Legal Issues Corporate Commercial Law China

Vie Like Structure Affirmed By Supreme People S Court In China